Whole Foods or Trader Joe’s? The battle of the niche grocers rages on.

Both hugely successful chains have solidified themselves in urban areas and are branching out. Both have roughly the same number of stores and offer many organic and non-GMO options, environmentally-friendly products, and their own brand lines.

But with Whole Foods test-driving its new 365 stores, smaller versions of Whole Foods similar to a Trader Joe’s model, we’re left wondering what the future holds. Can there be only one or will the natural rivals be able to cohabitate? Adding to the uncertainty, of course, are questions about what Amazon’s lucrative acquisition of Whole Foods and its many deals for Amazon Prime members mean for Trader Joe’s.

Taking a look at the habits, quirks and opinions of their shoppers offers some insight.

Overall Popularity Winner: Trader Joe’s

First, let’s get one thing out of the way. Neither Trader Joe’s or Whole Foods are among the top destinations for grocery shoppers — not by a stretch. People who buy most of their groceries at specialty natural/organic grocery chains make up a fraction of the population — about 5% of a CivicScience survey of over 45,100 U.S. respondents aged 13 and older. That doesn’t change even when looking exclusively at people who live in cities, where there are more Trader Joe’s and Whole Foods stores.

Most Americans buy the majority of their groceries at regional grocery chains, like Kroger or Safeway, or at supercenters, like Walmart. However, that’s not to say that they also don’t stop into a Trader Joe’s or Whole Foods to pick up certain items — they just don’t purchase most of their groceries there.

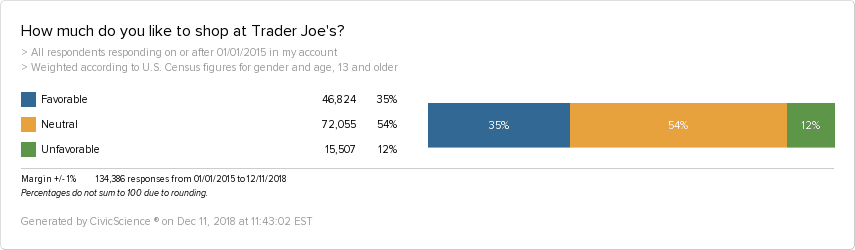

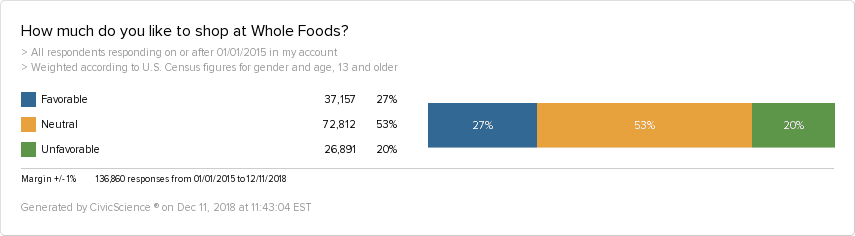

In fact, when looking at favorability — how much people like to shop at either store — CivicScience found in a survey of more than 134,000 U.S. respondents that more than one-third of the population likes or loves to shop at Trader Joe’s, while a little over one-quarter likes to shop at Whole Foods.

On the flip side, only 12% of those surveyed are unfavorable to Trader Joe’s and 20% are unfavorable to Whole Foods. That shows that despite not being the go-to grocery stores for most Americans, the brands are still popular, but Trader Joe’s has more favorability.

Customers Like Both Brands

While the two brands have different business models and products, as well as marketing — Trader Joe’s tiki theme is quirky while Whole Foods is more traditional — research shows that customers like to dip into both pots.

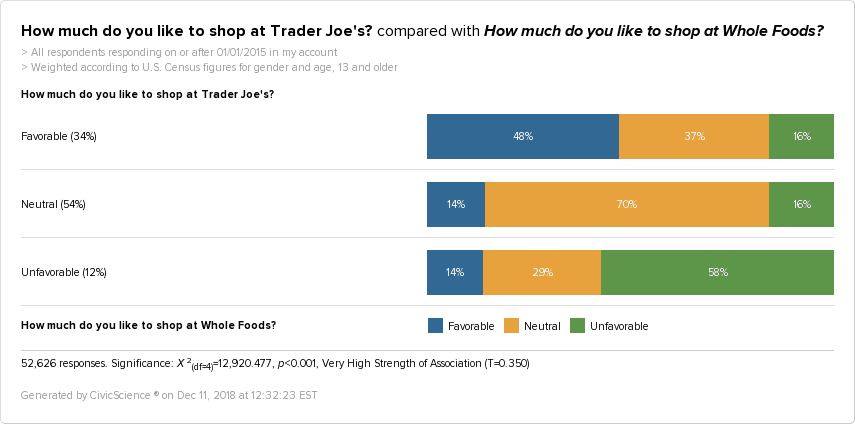

Nearly half of those who say they like or love to shop at Trader Joe’s also say they like or love to shop at Whole Foods. Plus, they are about 70% more favorable to shopping at Whole Foods than people who are neutral or unfavorable to shopping at Trader Joe’s.

Whole Foods has a higher rate of disloyalty among shoppers; a strong majority (64%) of those favorable to shopping there say they are also favorable to shopping at Trader Joe’s. Still, both stores are popular among their customers. The question then is, what leads shoppers into one store or another and what keeps some loyal to only one?

What’s Price Go to Do With It?

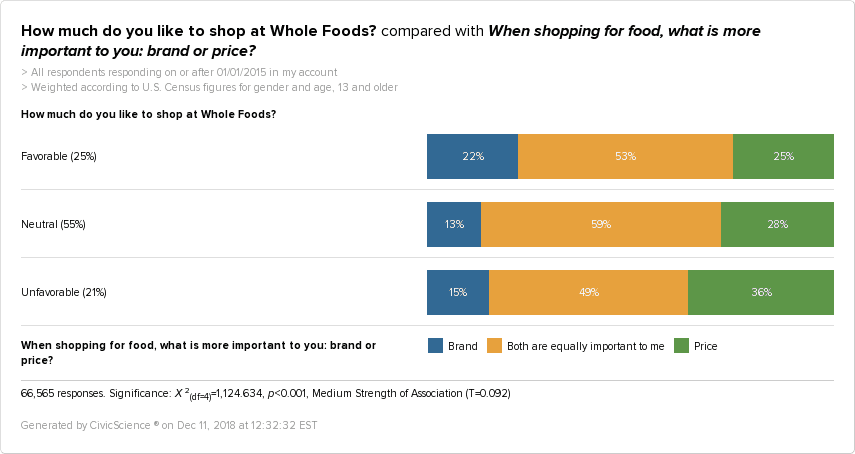

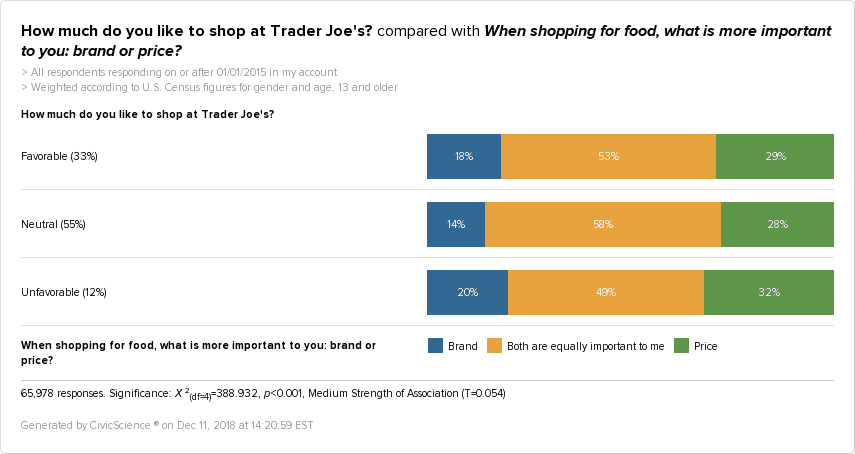

When asked which one was more important while shopping for food — brand or price — slightly more Whole Foods shoppers said brand, while slightly more Trader Joe’s shoppers said price.

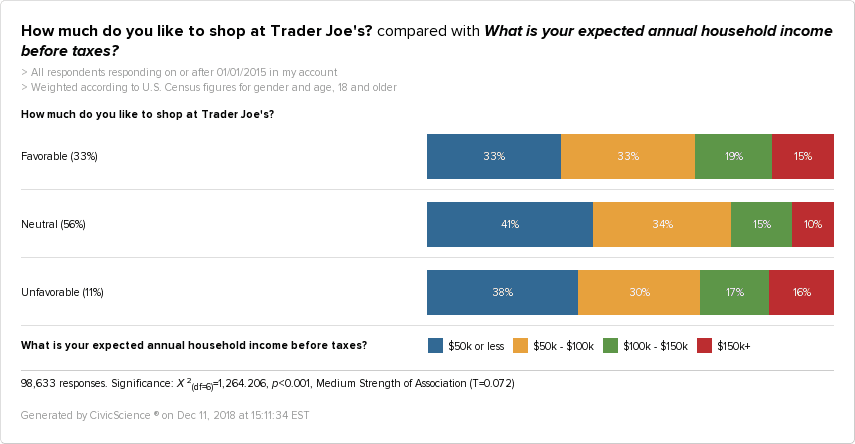

Although not a huge discrepancy, price, or rather perception of it, probably contributes to Trader Joe’s edge in overall favorability; Whole Foods is typically seen as more expensive than Trader Joe’s, earning the viral but mysteriously coined catchphrase ‘whole paycheck’. Income-wise, the survey shows Whole Foods has roughly the same income distribution among adults as Trader Joe’s, varying only by 1-2 percentage points.

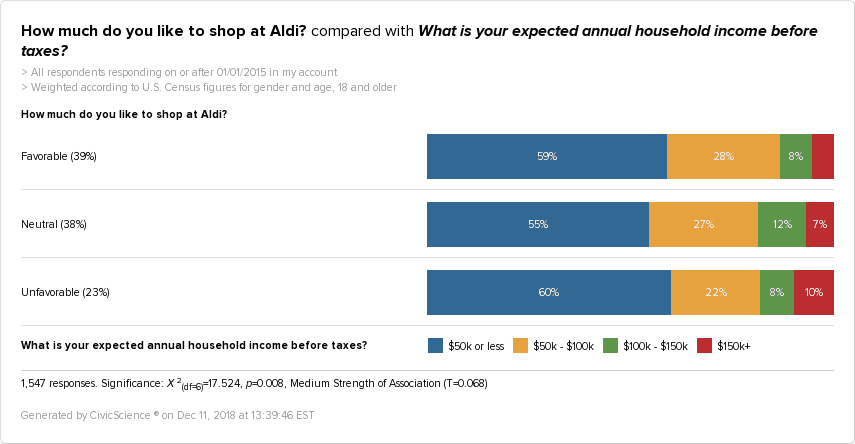

The survey data also shows that the more you make, the more likely you are to shop at either Trader Joe’s or Whole Foods. Compare that to Aldi, the German chain that’s been disrupting grocery retail in the U.S. Aldi attracts far more lower-income earners, helping to make it more favorable than Trader Joe’s or Whole Foods overall (42% favorability).

Price and income are obviously decisive factors for many when choosing where to buy groceries. When it comes to Trader Joe’s or Whole Foods, price may give Trader Joe’s a bump, but there are other factors to consider.

Whole Foods Has a Solid Lead with Organics

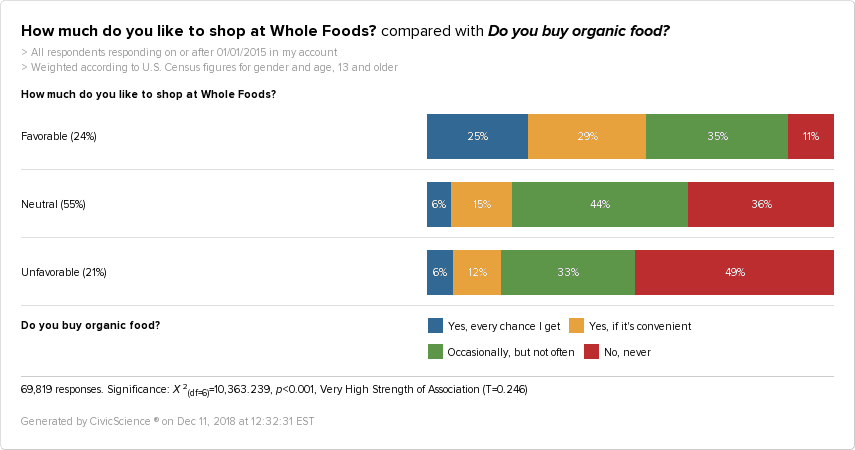

For the most part, both Trader Joe’s and Whole Foods shoppers mirror each other in nearly all ways. Compared to those neutral or unfavorable to the brands, those favorable to Whole Foods are more likely to buy organic, vegetarian or vegan, gluten-free, local food, as well as more environmentally-friendly products.

They also appeal more to foodies, those into health and fitness, women, teens and young adults, those who shop more online, use more social media, and follow technology trends, such as using grocery delivery services.

However, when it comes to organic food specifically, Whole Foods leads — organic food buyers are more than three times as likely to be favorable to Whole Foods. One-quarter of Whole Foods shoppers buy organic every chance they get. In comparison, Trader Joe’s has less avid organic food buyers.

More organic-food buyers flock to Whole Foods than Trader Joe’s, which despite lower popularity, likely gives Whole Foods its strong competitive edge.

Amazon’s Acquisition of Whole Foods

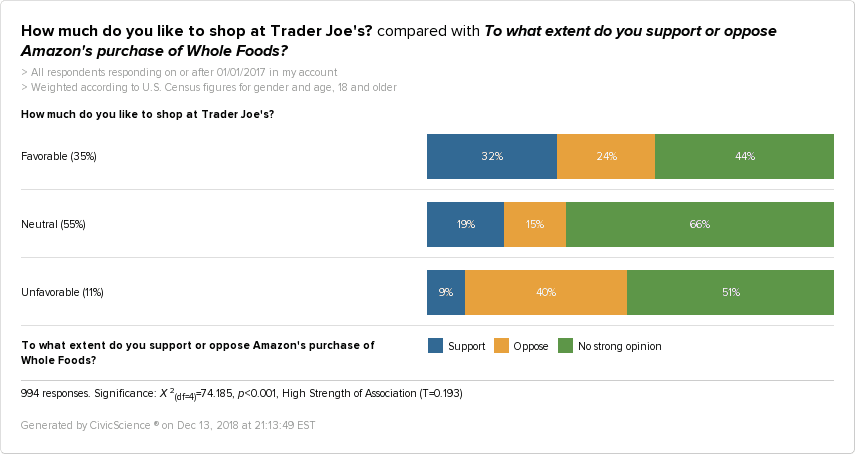

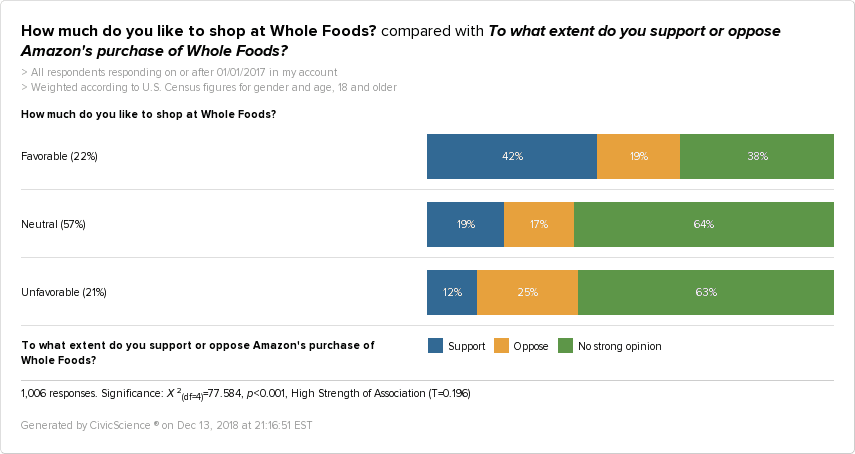

While there are a slew of other minor differences between the two brands’ customer habits, one glaring discrepancy surfaced that could play a role in which brand shoppers choose. Those favorable to Trader Joe’s are significantly more likely to oppose Amazon’s purchase of Whole Foods in 2017 (24%), compared to Whole Foods shoppers in opposition (19%).

For a customer base with such distinct niche characterizations, it’s not beyond the realm of possibility that some Trader Joe’s shoppers would avoid Whole Foods because of the acquisition. This may be helping to bolster Trader Joe’s overall favorability ratings, which appear to be growing faster than Whole Foods’.

Oddly enough, survey results show that those favorable to Trader Joe’s are more likely to subscribe to Amazon Prime (48%) than those who are favorable to Whole Foods (41%). That’s especially strange, given that Prime members receive a discount at Whole Foods.

These nuances warrant more probing into what lies behind them. For now, the takeaway is that Amazon’s acquisition may play a role in whether or not someone is favorable to Trader Joe’s or Whole Foods, in addition to the price of products and organic selection.