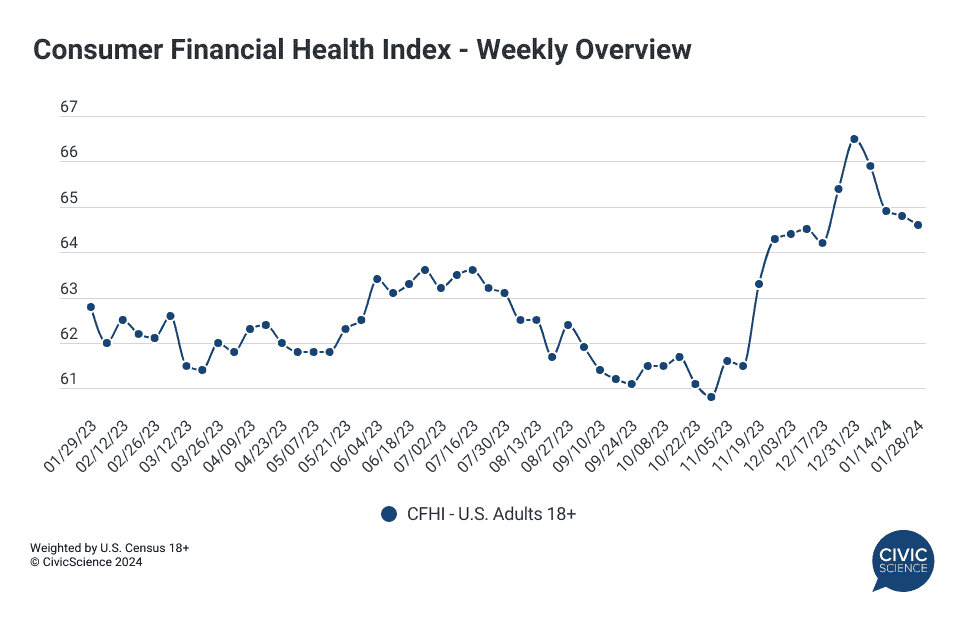

The new year brought with it a wave of positivity for Americans when it came to their financial outlook. But a look at the CivicScience Consumer Financial Health Index, which measures the collective financial health of the nation, shows that wave has rolled back after peaking at the start of January. Weekly financial outlook continues to trend downward, falling to 64.6% this past week.

Join the Conversation: How confident are you in the current state of your finances?

The drop coincides with falling consumer economic confidence – the Penta-CivicScience Economic Sentiment Index also declined in January, with confidence in personal finances and buying a new home falling the most.

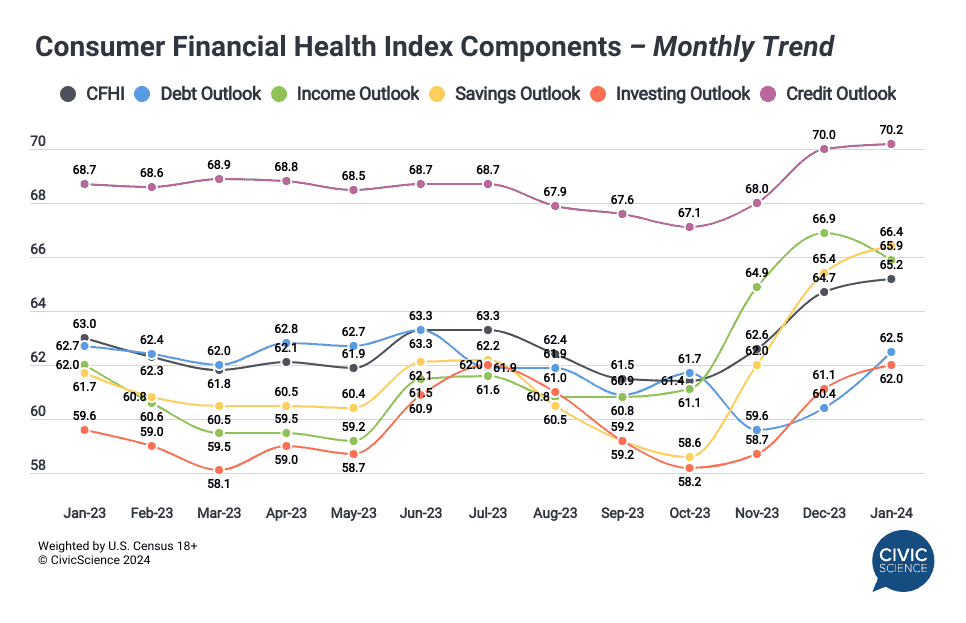

However, as a monthly average financial outlook increased from December to January, rising 0.5 points to 65.2%, although likely reaching a plateau. As a living index, the CFHI tracks changing consumer outlook for the next six months by measuring a range of ‘always-on’ questions that span across five key financial areas: debt, income, savings, investing, and credit score. The biggest negative changes in January were seen with consumer income and debt expectations.

Compared to today, a growing number of consumers expect in six months time to have:

- Lower income (declining 1.0 point to 65.9%)

- Less debt (increasing 2.1 points to 62.5%)

- More money saved (increasing 1.0 point to 66.4%)

- More in investments, including retirement savings (increasing 0.9 points to 62.0)

- Slightly better credit score (increasing 0.2 points to 70.2%)

Although financial health still remains at higher levels than during most of 2023, holiday debt, student loan repayment, and stress over managing living expenses could all take their toll. To learn more about the financial outlook of your brand’s target audiences, get in touch.

Take Our Poll: How’s your financial health? 💰