With spring officially sprung and Easter just around the corner, grocery lists are well underway for many Americans celebrating this year. The latest CivicScience data provide insight into consumers’ shopping plans – from what they’ll serve for dinner to how they’ll fill their Easter baskets, and everything in between.

Celebrations and Spending Expectations

This year, 84% of U.S. adults will be celebrating Easter. More than 40% will be celebrating at home with their household or hosting family and friends, holding steady from last year’s numbers. Nearly 3-in-10 will spend it away from home, at family or friends’ houses or community events (n=1,832 responses from 3/20/2024 to 3/25/2024).

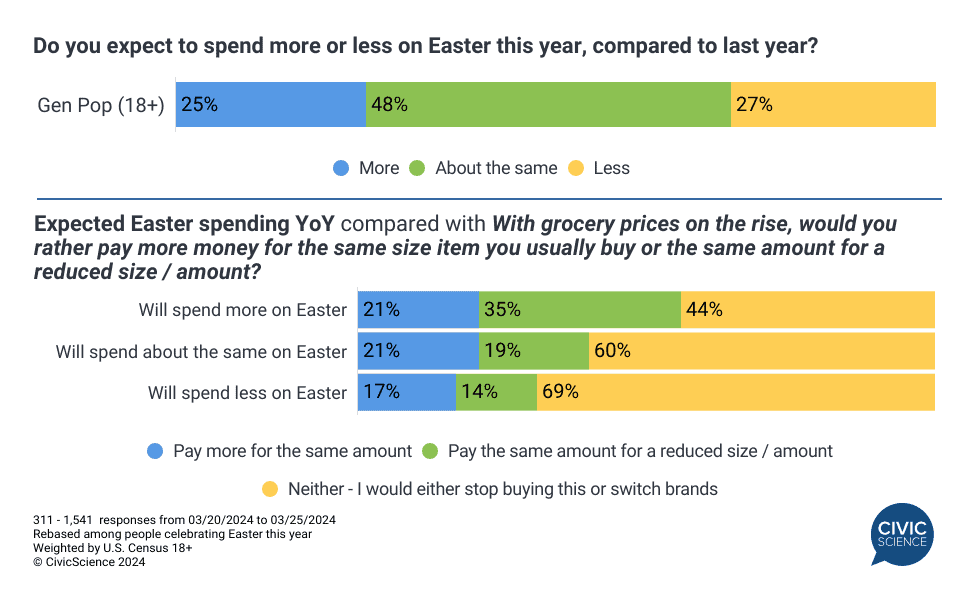

Among those who celebrate, 48% expect to spend the same amount on Easter-related shopping as they did in 2023, although a slightly higher percentage anticipate spending ‘less’ than ‘more’ on the holiday as a whole.

Spending expectations among Easter celebrators are likely to play out differently at the grocery store. Those who do plan to spend more are also more likely to be loyal to their favorite brands, as they’re more likely purchase reduced sizes of grocery items without a reduction in price – the ‘shrinkflation’ we’ve seen sweep across stores in recent months – instead of switch brands. Those who plan to spend less on Easter are much more likely to switch brands to avoid shrinkflation or paying higher prices for grocery items.

Top Easter Entrées

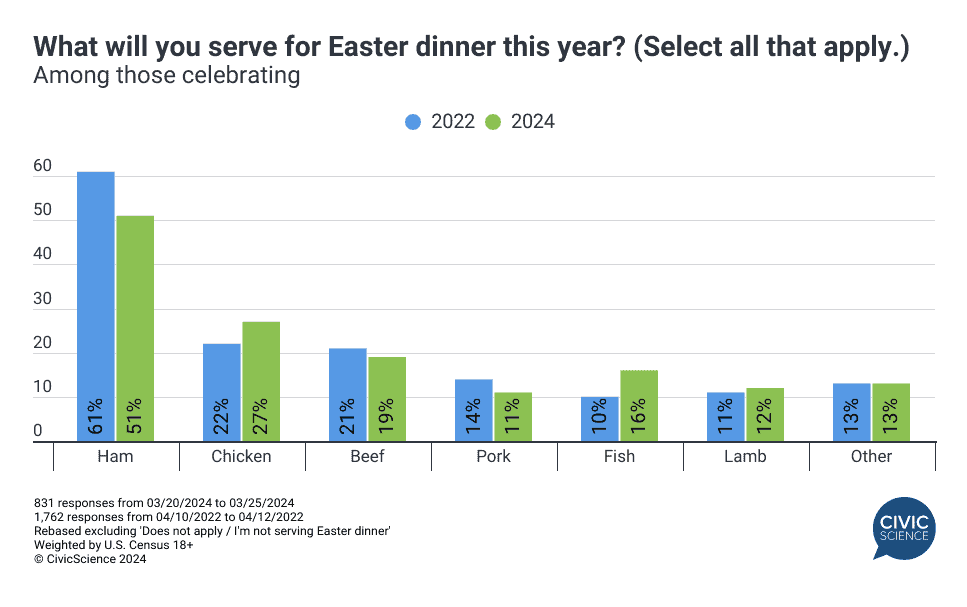

Given spending expectations, what will make an appearance on dinner tables? Although ham maintains its top spot on the Easter menu with 51% of those preparing dinners planning to serve it up this year, that percentage has fallen 10 points since 2022. This year, more households plan to serve chicken, fish, and lamb. Beef and pork are also less popular options this Easter.

Take Our Poll: Is ham a staple of your Easter dinner spread?

Easter Basket Plans

Nearly two-thirds of Americans say they will be purchasing candy for Easter. Just 17% of these shoppers will be buying a pre-made Easter basket from retailers, which means the majority of Americans have a fair amount of candy buying in their immediate future (n=817 responses from 3/20/2024 to 3/25/2024)

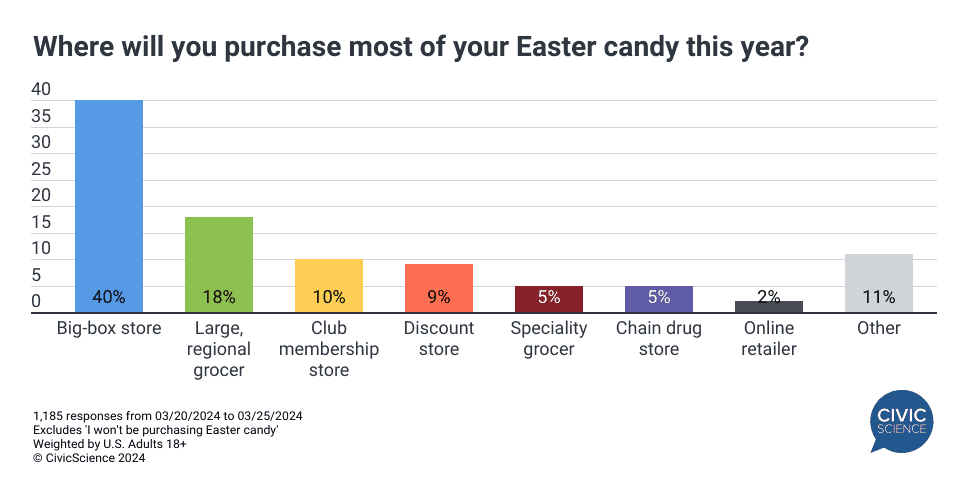

So, how will Americans fill their baskets? Among buyers, 40% will be buying the bulk of their Easter candy from a big-box store such as Walmart, while 18% will shop at a large regional grocer like Kroger and 10% will take advantage of savings at a club membership store such as Costco. Discount stores such as Dollar Tree will also see some action (9%), as more consumers turn to dollar stores for groceries. Surprisingly, a mere 2% say they will be buying their candy from online retailers such as Amazon.

Top Candy Brands Ranked

Ongoing CivicScience polling shows that Reese’s continues its reign as the top chocolate brand this year – 46% of U.S. adults say they have purchased a Reese’s product in the last month. But Hershey’s comes in a close second (44%), with M&M’s trailing in third (40%) (n=16,475 responses from 2/24/2024 to 3/25/2024).

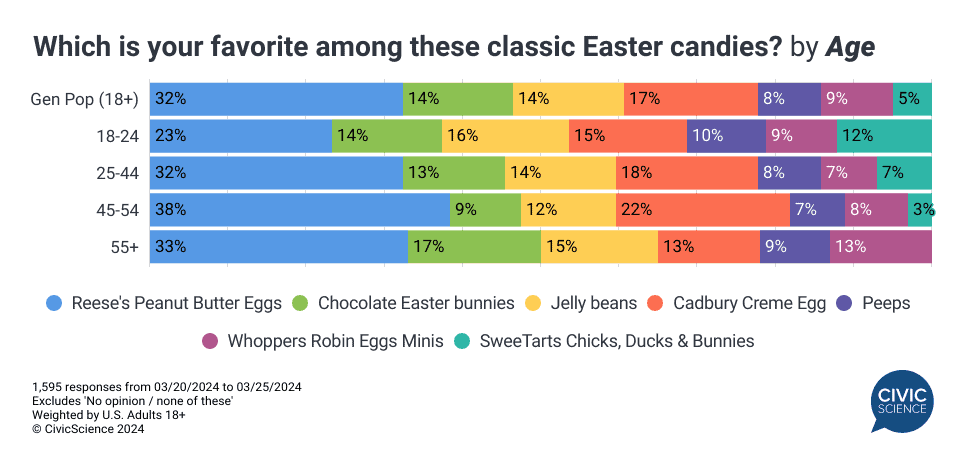

As a result, it’s not surprising that Reese’s Peanut Butter Eggs take the top spot for favorite classic Easter candy. Cadbury Creme Egg and Chocolate Easter bunnies are tied for second.

Additional insights correlate to age. Reese’s Peanut Butter Eggs are a big hit among Gen X, while Gen Z is the least likely to favor them and the most likely to prefer jelly beans, Peeps, and SweeTarts Chicks, Ducks & Bunnies. Meanwhile, those 55+ are the most likely to fill their Easter baskets – and bellies – with Whoppers Robin Eggs Minis.

Join the Conversation: Do you exchange Easter baskets with your family / partner / friends?

This year, Americans will continue their Easter celebrations as planned. While certain traditions remain – ham will be served (although less frequently) and Reese’s Peanut Butter Eggs will be gobbled from baskets – this holiday hasn’t escaped the sweep of inflation, begging the question: how long will Americans continue to celebrate as usual, before cost-saving measures become a higher priority?

Follow these and more retail insights among your target audiences with the CivicScience InsightStore, gathering more than 4 million daily responses from consumers across the U.S. Contact us to learn more.