You should bet on women’s sports.

I’m not talking about laying down a wager at a casino or sportsbook app, though feel free to do that too, if that’s your thing. I’m talking about marketing.

Women’s sports are a juggernaut.

This is by no means a hot take. A quick Google search will lead you to dozens of articles (including some of ours) about the meteoric rise of viewership and attendance at college and pro women’s sporting events.

Literally as I started writing this, an article from Variety popped up in my social feed about the mega-agency, GroupM, doubling the money their blue-chip advertising clients spend on women’s sports this year. They know what’s up.

Variety even stole my thunder by mentioning Ally Financial, who pushed GroupM to make the commitment. I was already planning to shower praise on Ally’s Chief Marketing Officer, Andrea Brimmer, incidentally one of the very first guests on my podcast three years ago. A decorated soccer player in her own right, nobody puts their money where their cleats are like she does. And, when the job security of CMOs today is only slightly better than that of a video rental clerk, Andrea wouldn’t be 9+ years in the gig if those investments didn’t perform.

The numbers aren’t even up for debate anymore. Iowa and Caitlin Clark’s second-round game on Monday drew higher ratings than any March Madness cable broadcast – women’s or men’s – this year. Nelly Korda helped push viewership of the LPGA to record heights in 2023. Women’s gymnastics, per usual, will be the most watched Olympic sport this summer. I could go on.

But the raw numbers aren’t the biggest story. The quality of women’s sports fans compounds the quantity. They’re younger, more gender-balanced, tech-savvy, multicultural, and brand-loyal than fans of men’s sports. Fans of the National Women’s Soccer League are 3X more likely than non-fans to switch banks this year. WNBA fans are 5X more likely to buy products from Olympic sponsors. Fans of the new Professional Women’s Hockey League are 3X more likely to be frequent business travelers.

While we’re no GroupM (yet), we tell our advertising clients – until we’re blue in the face – that understanding and reaching women’s sports fans is one of the most valuable things we can do for them. It’s only going to get more and more expensive.

Trust me.

Here’s what we’re seeing:

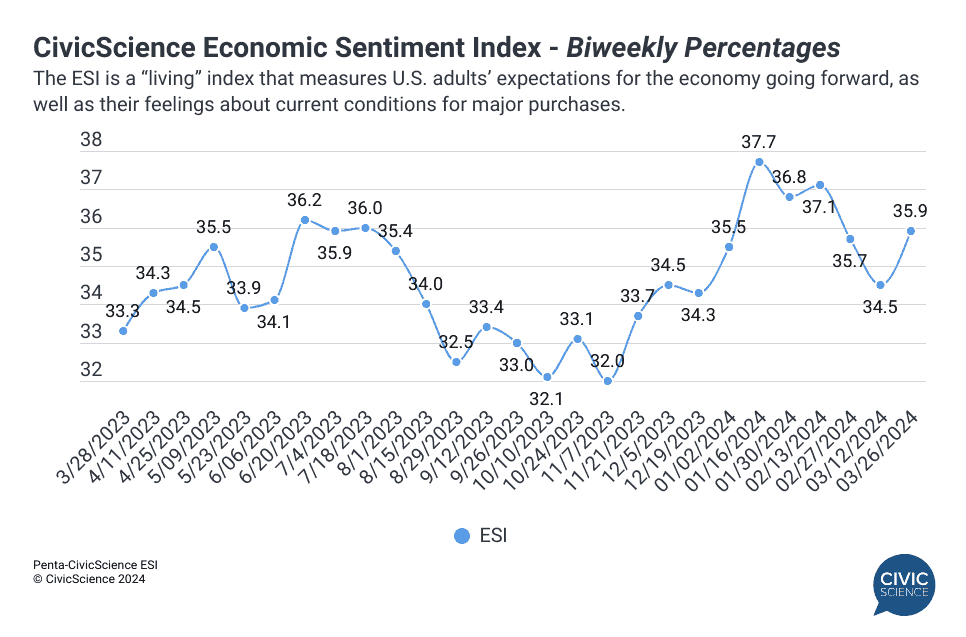

Consumer confidence had a nice little surge this week. Our Economic Sentiment Index had its biggest improvement since early January, jumping nearly 1.5 points in our latest reading. Four of our five main indicators climbed, with confidence in the housing market being the only negative. I wish I could tell you why. Core inflation remains pesky. State-level job numbers aren’t awesome. Gas prices are up. Maybe the rosy GDP outlook or the booming stock market are buoying sentiment. I’m not sure. Nonetheless, people are feeling better and that’s a good thing.

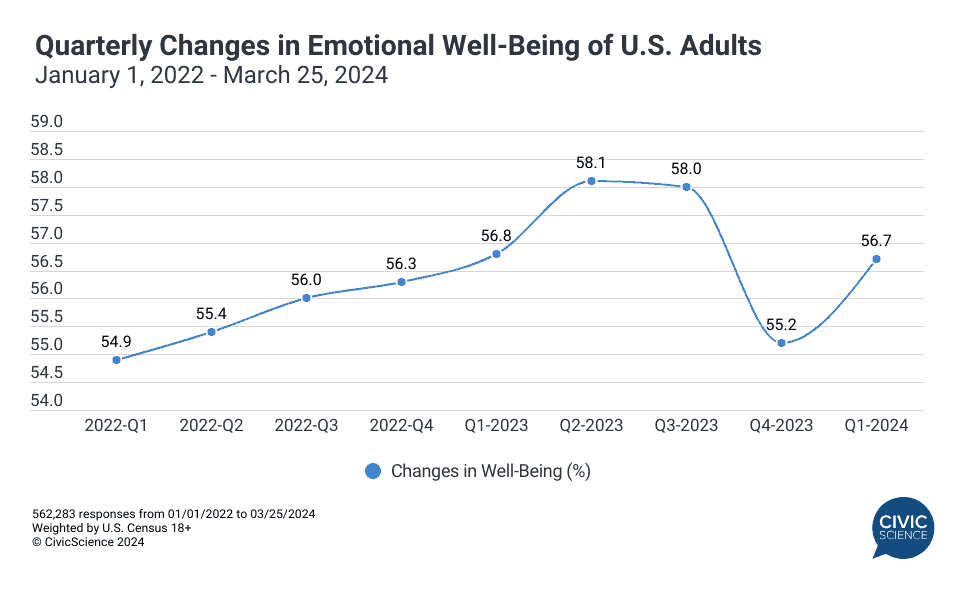

No, I mean it; people are actually feeling better. Adding to the good news this morning, our latest Well-Being Index is hot off the press and it’s lovely. After a super-lousy Q4 and a sluggish February, the mood of U.S. adults in March bounced back, with overall Q1 numbers matching those of last year. It’s not uncommon for emotional well-being and consumer confidence to be correlated – money can, indeed, buy happiness – but not always. Personally, I credit the weather. I’m in a way better mood.

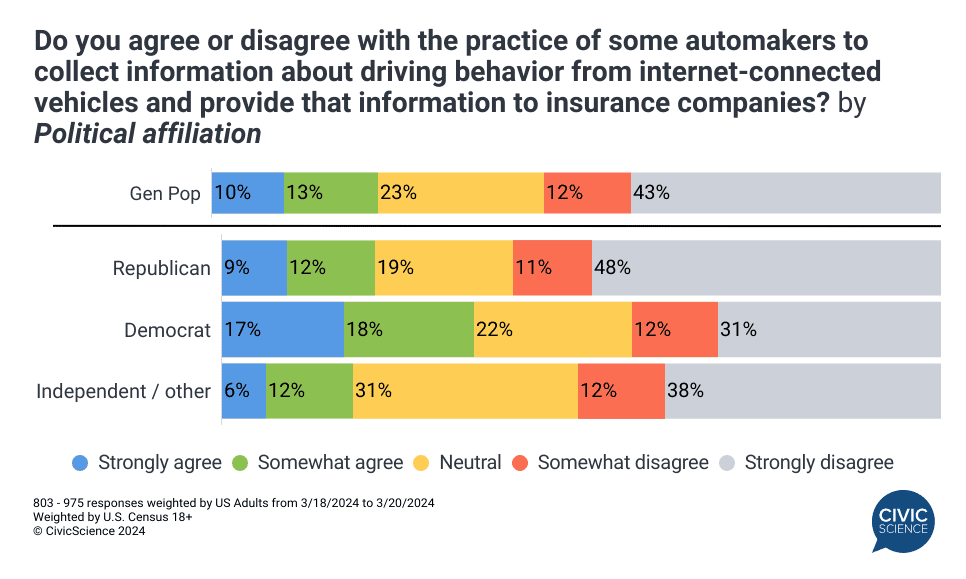

Americans really don’t want automakers to share driver data with insurance companies. In our 3 Things to Know this week, we examined how people feel about the practice of some car companies that pass drivers’ behavioral data to insurers. A clear majority of adults oppose the practice. Interestingly, the results vary a bit by political party. Albeit even more partisan, we also found that 45% of Americans are optimistic about President Biden’s women’s health research initiative (versus 22% who aren’t so optimistic). Lastly, we learned that buy-one-get-one promotions are people’s favorite.

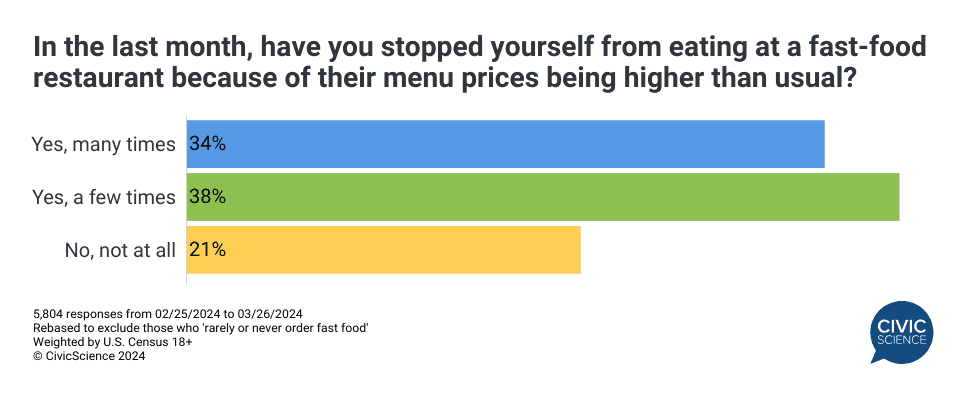

Dynamic pricing says, “Hold my beer.” If you want to see a practice that really pisses people off, look at the consumer data on the concept of dynamic pricing. In fairness, some of the vitriol is borne of a misunderstanding. In some cases, prices do drop when adjusted for demand dynamically. But most people don’t see it that way. A whopping 68% of U.S. adults view dynamic pricing as synonymous with price gouging. While the practice might make business sense in particular moments, the taste it leaves in disgruntled customers’ mouths could have long-term ramifications.

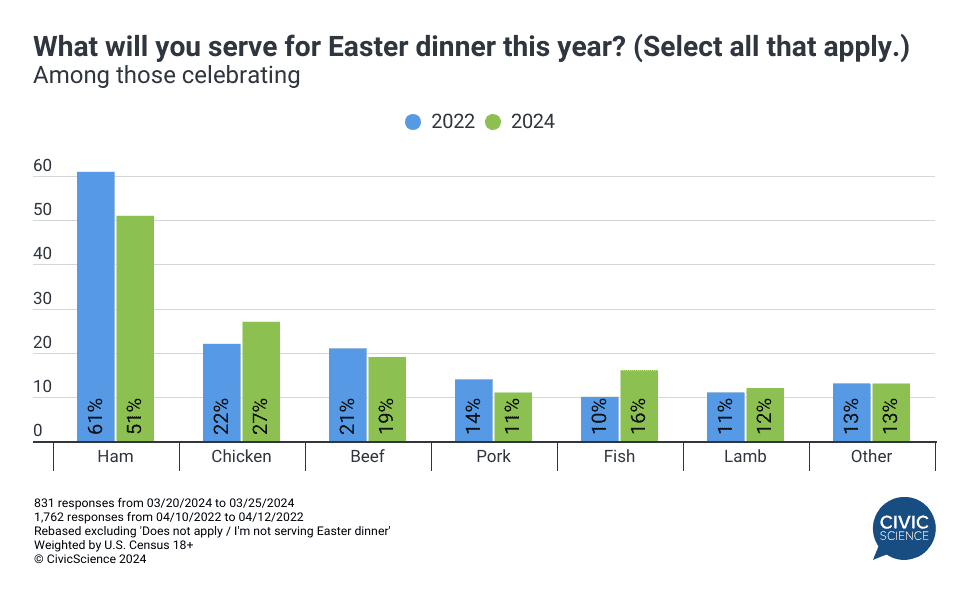

The dominance of Easter hams is waning. Our annual study of Americans’ Easter celebrations was resurrected this week (I’ll show myself out) and it echoes a few bigger consumer trends. While a majority (51%) of Easter celebrators plan to serve ham at their holiday dinner, it’s down from 61% just two years ago. Beef and pork also fell, to be replaced by chicken and fish, which increased by 5 and 6 percentage points, respectively, since 2022. Meanwhile, 50% of Easter candy buyers will buy most of their sweets at big-box or club membership stores. Slumping regional grocery chains will score only 18% of shoppers. One thing that hasn’t changed is the undisputed popularity of Reese’s Peanut Butter Eggs.

More awesomeness from the InsightStore™ this week:

People (even Pirates fans) are excited about the new baseball season;

Amazon’s Big Spring Sale was…um…big, especially for beauty and health shoppers;

Key things to know about Reddit users following their IPO;

Kroger shoppers love coupons and other notable insights.

The most popular questions this week:

Have you ever been a victim of the ‘reply all’ button?

Have you ever purchased an item from an auction?

What is your favorite way to cook salmon?

How far does your online persona deviate from your face-to-face persona?

Are you more of a bar soap or liquid soap type of person?

Answer Key: Ugh, yes; Many times, it’s so fun; Blackened and grilled; Zero; Bar soap in the shower, liquid soap in the sink.

Hoping you’re well,

JD

Sign up for a free seven-day trial of our Sage AI-powered consumer analytics assistant, which lets you explore our database of 5+ billion insights and 500,000+ questions.

Not on the list to receive this email? Sign up here. If you are new to this list, check out our Top Ten to get caught up.